The Export Determinants of Indonesian Cut Flower in The International Market

Niza Arumta(1*), Jangkung Handoyo Mulyo(2), Irham Irham(3)

(1) Direktorat Jenderal Hortikultura, Kementerian Pertanian Republik Indonesia

(2) Universitas Gadjah Mada

(3) Universitas Gadjah Mada

(*) Corresponding Author

Abstract

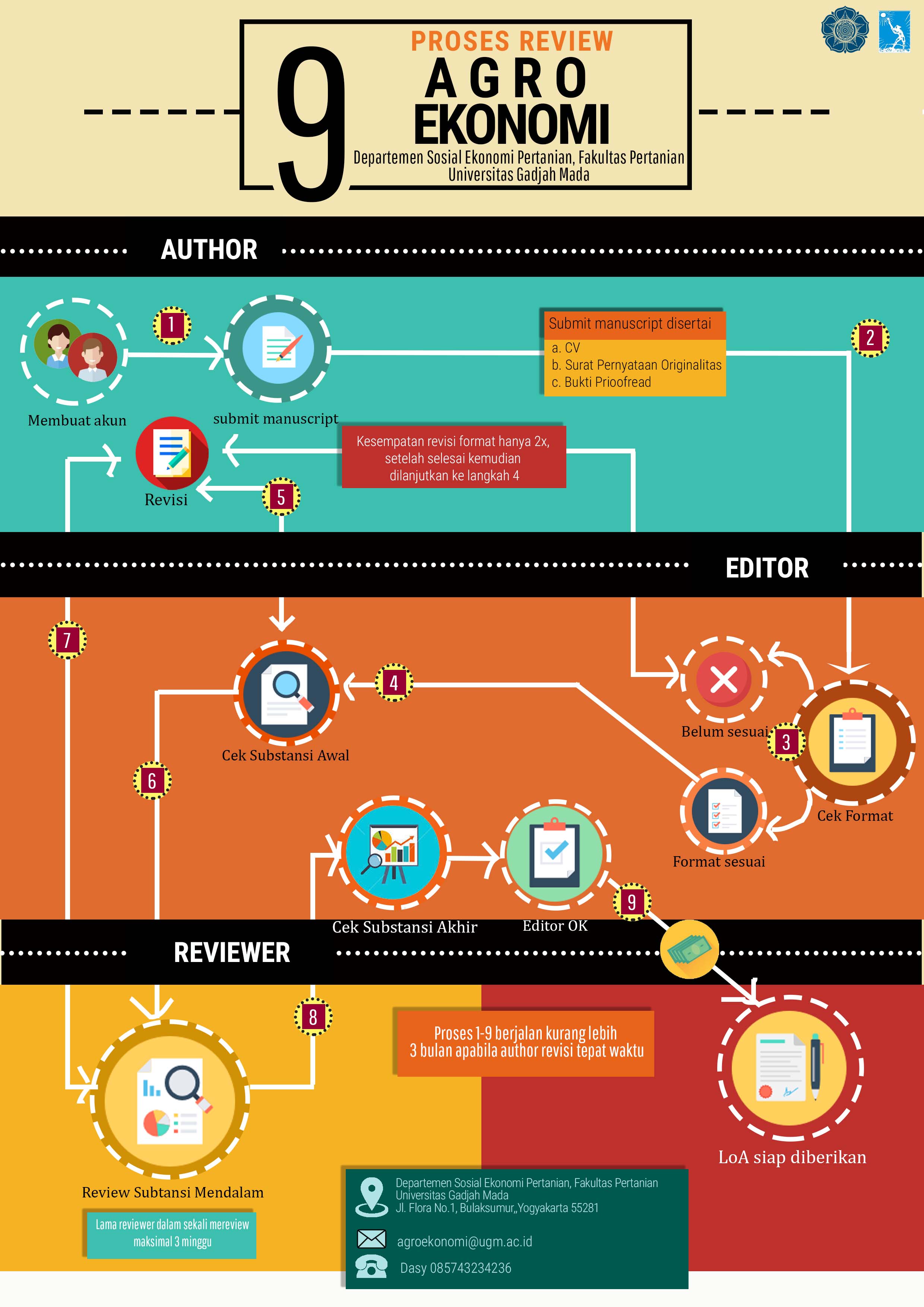

Trade statistics of Indonesian cut flower indicates the potential of Indonesia as an exporting country. The international market becomes more attractive as the increasing trend of demand and the rising cost for producing cut flowers shows the various challenges for emerging countries. This study investigates whether the analytical gravity model fixed effect, common effect or random effect model is proper and what determinants have significant effects to the exports of Indonesian cut flower to partner countries. The data encompasses the period of 2008 to 2017 as the series data and the seven destination export countries from Indonesia as the cross-sectional data, using the panel regression with the basic gravity model. The estimation results show the fixed effects model is the proper model to explain the determinants of bilateral export on cut flower. The estimates imply the corroborate signs with GDP per capita of Indonesia, GDP per capita of partner countries and exchange rate while those variables with the opposite sign are distance and trade openness. Thus, the export promotion, quality improvement and technology development are required in the development of export of cut flower industries.

Keywords

Full Text:

PDFReferences

Abidin, I. S. Z., Bakar, N. A., & Sahlan, R. (2013). The Determinants of Exports between Malaysia and the OIC Member Countries: A Gravity Model Approach. Procedia Economics and Finance, 5(13), 12–19. https://doi.org/10.1016/s2212-5671(13)00004-x

Baltagi, B. H. (2013). Econometric Analysis of Panel Data - Fifth Edition. In John Wiley & Sons, 2013.

Baum, C. F., & Caglayan, M. (2010). On the Sensitivity of the Volume and Volatility of Bilateral Trade Flows to Exchange Rate Uncertainty. Journal of International Money and Finance, 29(1), 79–93.

Berthelon, M., & Freund, C. (2008). On the conservation of distance in international trade. Journal of International Economics, 75, 310–320. https://doi.org/10.1016/j.jinteco.2007.12.005

Carrère, C., de Melo, J., & Wilson, J. (2013). The distance puzzle and low-income countries: An update. Journal of Economic Surveys, 27(4), 717–742. https://doi.org/10.1111/j.1467-6419.2011.00715.x

Coe, D. T., Subramanian, A., & Tamirisa, N. T. (2007). The missing globalization puzzle: Evidence of the declining importance of distance. IMF Staff Papers, 54(1), 34–58. https://doi.org/10.1057/palgrave.imfsp.9450003

Falvey, R., Foster, N., & Greenaway, D. (2012). Trade Liberalization, Economic Crises, and Growth. World Development, 40 (11), 2177–2193. https://doi.org/10.1016/j.worlddev.2012.03.020

Gervais, A. (2015). Trade and Growth: A Gravity Approach. Southern Economic Journal, 82(2), 453–470. https://doi.org/10.2139/ssrn.2137159

Gujarati, D. N., & Porter, D. C. (2009). Basic Econometrics (5th ed.). In Basic Econometrics.

Huchet-Bourdon, M., Le Mouël, C., & Vijil, M. (2018). The relationship between trade openness and economic growth: Some new insights on the openness measurement issue. World Economy, 26(3), 266–277. https://doi.org/10.1111/twec.12586

Karemera, D., Managi, S., Reuben, L., & Spann, O. (2011). The impacts of exchange rate volatility on vegetable trade flows. Applied Economics, 43(13), 1607–1616. https://doi.org/10.1080/00036840802600137

Karemera, D., Reinstra-Munnicha, P., & Onyeocha, J. (2009). Impacts of Free Trade Agreement on US State Vegetable and Fruit Trade Flows. Journal of Economic Integration, 24(1), 116–134. https://doi.org/10.11130/jei.2009.24.1.116

Keller, B. W., & Yeaple, S. R. (2013). The Gravity of Knowledge. The American Economic Review , Vol . 103 , No . 4 ( JUNE 2013 ), pp . 1414-1444 Published by : American Economic Association Stable URL : 103(4), 1414–1444.

Levchenko, A. A., Giovanni, J., & Levchenko, A. A. (2009). Trade Openness And Volatility. The Review of Economics and Statistics, 91(3), 558–585.

Mafizur, M. (2010). The Factors Affecting Bangladesh ’ S Exports : Evidence From The Gravity Model Analysis. The Journal of Developing Areas , Vol . 44 , No . 1 (Fall 2010), pp . 229-244 Published by : College of Business , Ten. 44(1), 229–244.

Rahman, M. M. (2009). Australia’s Global Trade Potential: Evidence from the Gravity Model Analysis. Oxford Business & Economics Conference Program, (October). Retrieved from https://eprints.usq.edu.au/5537/1/Rahman_OBEC_09_PV.pdf

Silva, J. M. C. S., & Tenreyro, S. (2006). The Log of Gravity. The Review of Economics and Statistics , Vol . 88 , No . 4 ( Nov ., 2006 ), pp . 641-658 Published by : The MIT Press Stable URL : http://www.jstor.org/stable/40043025. 88(4), 641–658.

Trung Kien, N. (2010). Gravity Model by Panel Data Approach: An Empirical Application with Implications for the ASEAN Free Trade Area. Asean Economic Bulletin, 26(3), 266–277. https://doi.org/10.1355/ae26-3c

Article Metrics

Refbacks

- There are currently no refbacks.

Copyright (c) 2018 Agro Ekonomi

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

View My Stats